Offshore Wealth Management for Beginners

Wiki Article

Indicators on Offshore Wealth Management You Should Know

Table of ContentsOffshore Wealth Management - TruthsThe Best Guide To Offshore Wealth ManagementRumored Buzz on Offshore Wealth ManagementOffshore Wealth Management for Dummies

8 billion), and in 2022 a total amount of $8. 4 billion was elevated with IPOs, which saw need over of $180 billion from local and also global investors. Hereof, we are all regarding proceeding to build on this development as well as energy and also unlock the possibility of the marketplace and lead the way for personal market IPOs.An archetype of this is DET's current collaboration with Dubai Globe Trade Centre, Dubai Chamber of Digital Economic situation as well as various other stakeholders to drive global rate of interest and also participation at GITEX Global 2022 and also North Star Dubai 2022. We were motivated to see our initiatives happen as the technology show brought in greater than 170,000 guests, 40 percent of whom were international, while the event itself created an estimated $707 million in complete financial outcome.

Our approach goes far beyond advertising Dubai as well as bring in companies to establish procedures in the Emirate. It is designed to look at the full influence advantages that the Emirate can use as a global wide range hub by tracking the variety of business linked to the wealth management field, along with the number of jobs, skills and also staff members that they would bring to the market. offshore wealth management.

Offshore banks will certainly maintain all your financial documents in depend on because it does not mandate you to share such details with anyone else, including the government. These banks will use you financial personal privacy that the majority of neighborhood financial banks can not afford. One benefit of offshore banking is that it allows you to open offshore foundations.

See This Report on Offshore Wealth Management

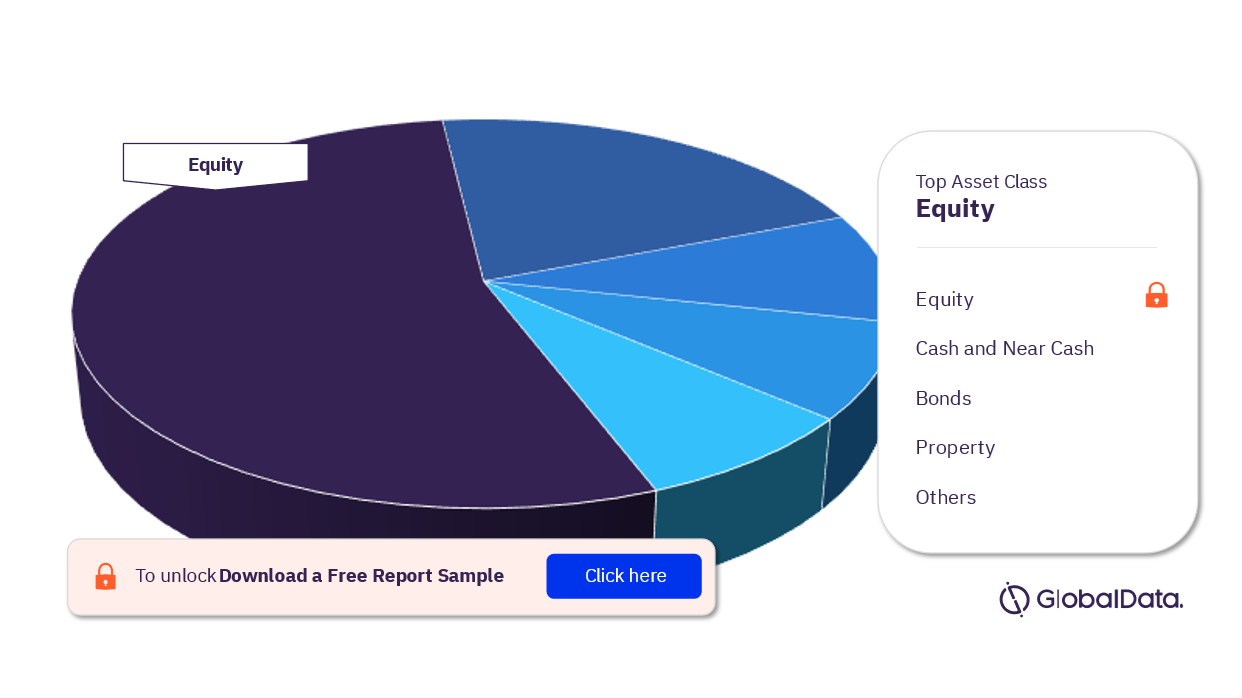

Many of the funds transferred to an overseas account for protection are not kept in safes or by financial institutions. The wide range can great site be distributed amongst different business or spent for financial gain by the overseas wealth security firm.

Offshore territories offer the advantage of privacy legislation. Many of the countries that are extended for overseas banking have currently applied legislations establishing high requirements of financial privacy.

Offshore Wealth Management Fundamentals Explained

In the situation of money laundering or medicine trafficking, overseas laws will certainly enable identity disclosure. Nations have actually ended up being experienced at securing their markets versus exploitation by worldwide investors. Some financiers, especially those that have an interest in a massive as well as varied portfolio, really feel limited by these markets. Overseas accounts to not have any type of restrictions.They have actually shown to be several of the most lucrative markets where investors can promptly diversify their investments. Together, a lot of the offshore accounts remain in establishing countries where there are hundreds of investment possibilities as well as untapped potential. A few of the federal governments are beginning to privatize some of the markets, which is offering investors a chance to get big financial investment opportunities in these expanding customer markets.

Tax obligation motivations are presented as one method of encouraging foreigners to invest as well as therefore enhance financial activities. Purchasing offshore riches monitoring is an appealing opportunity to meet the needs of the most affluent of financiers. If you want to invest your properties in an offshore check my blog account, you can take advantage of a more comprehensive array of investments, possession defense, and also tax obligation advantages.

Some Known Questions About Offshore Wealth Management.

Offshore financing is one such organization activity! Offshore money can assist services offshore essential financial tasks, such as intricate finance testimonials, tax obligation preparation, governing conformity, etc.

That does not have to include you! In this article, we'll address 12 of the most frequently asked inquiries regarding offshore financing. At the end of this read, you would certainly be able to comprehend vital principles, such as tax havens, offshore accounts, tax evasion, and a lot more.

These services consist of tax regulative compliance, wealth management, economic testimonials, and so on. Firms might offshore fund to an overseas nation for numerous factors, including: Asset protection and protection. Much better tax regimes.

Keep in mind that companies can offshore fund either with an outsourcing arrangement with a third-party solution company or by establishing their in-house team overseas. Below's a more detailed look at the 3 essential types of offshore money solutions: Offshore finance services refer to contracting out financial business activities overseas.

Report this wiki page